Amazon notice: Do not upload a French VAT number or be prohibited from selling

2021-06-08(2147)Views

A few days ago, Amazon issued a notice on the seller's platform, requiring sellers who meet the requirements of the French Anti-Fraud Act to immediately upload French and European VAT numbers (the notice is as follows).

Regarding French tax compliance, in addition to timely registration and upload of tax number information, it also includes registration, declaration and payment of VAT with the French Tax Agency (FTA) in accordance with your applicable legal requirements.

Based on the above requirements, the seller needs to perform corresponding compliance operations according to the following requirements.

The first step:

Determine whether you need to upload a French/European VAT number

Although there are many situations where French VAT registration is required, for most Amazon sellers, the three most common situations are:

· Your company is outside France, but stores inventory and delivers orders in France; or

· You deliver goods to a French buyer from another EU country/region (non-France) where your inventory is stored, and the total amount of your annual sales to French buyers exceeds €35,000; or

· You set up a company in France and deliver goods from France to French buyers, and your annual sales in all sales channels exceed €82,800.

Need to upload European VAT number:

The French Anti-Fraud Act requires that if you have met the VAT registration requirements of other European countries/regions, you need to have a European VAT number and upload the VAT number of all European countries that you have registered. Sellers who have not uploaded a European VAT number on the seller’s platform may not be able to continue to sell products on the Amazon France site or sell products to French buyers.

For example, if you sell from an Italian warehouse to French consumers over a long distance, and you do not exceed the French long-distance sales threshold of 35,000 EURO, you need to upload the Italian VAT number to the seller’s post platform, because this transaction means that you have inventory in Italy. If you have not uploaded a European VAT number on the seller’s platform, you may not be able to continue to sell goods on the French site or sell goods to French buyers.

The second step:

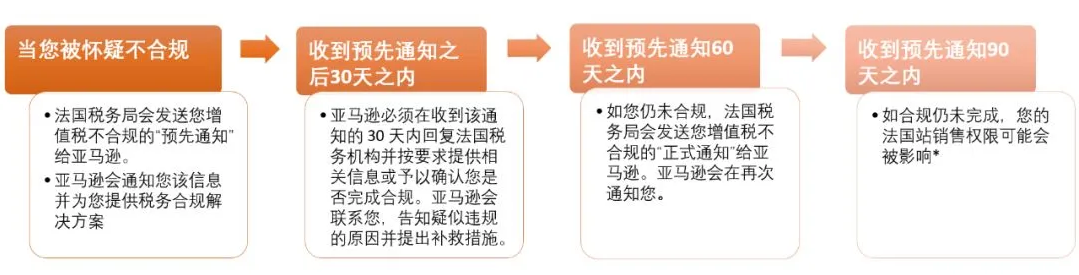

Did not comply with the regulations in time? You may face these follow-up measures

*Amazon will cooperate with the French tax authorities when required by law to remove them from our European mall when they receive notifications of non-compliance with relevant sellers.

Step 3: Are you ready to register? Prepare tax compliance solutions in time

In 2019, Amazon conducted a survey of 60 sellers who recently uploaded a French VAT number on the seller’s platform. The results showed that only 65% of the sellers completed the process within three months, and 35% of the sellers did not have 3 Complete within a month. Amazon recommends that sellers start to register as soon as possible to better sell on Amazon Europe and expand their European business.

Step 4: Get the tax number and prepare to upload? You need to know these

The seller can upload the VAT number to the seller's platform from the following path:

Settings-Account Information-VAT Calculation Settings-Add VAT/Goods and Service Tax Registration Number

*The local tax identification number is an official tax identification number established by the seller in accordance with the law. If your company is established in France, your local tax identification number is the SIRET number.

Other common problems

Question 1: If I use FBA services in other countries/regions, and I have a return of a European distribution network sold in a French warehouse. Do I need to have a French VAT number for this product?

If you authorize the storage of inventory in France, but the inventory kept in France is in a saleable condition, you need to upload the French VAT number on the seller's platform.

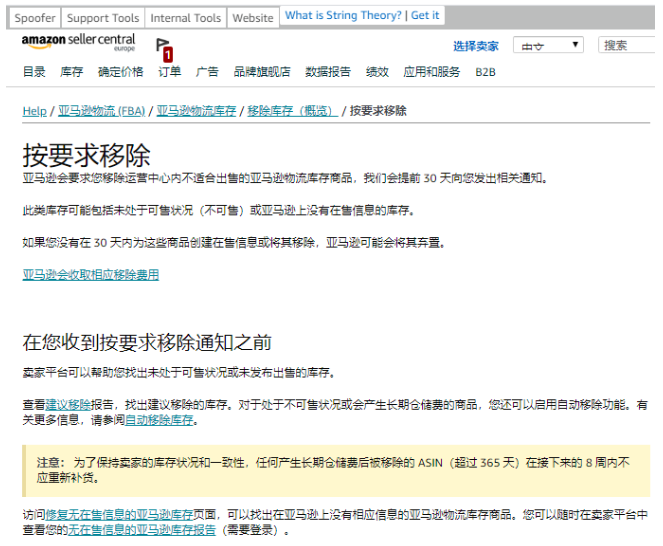

Question 2: If my sales authority is removed, what will happen to my inventory in France?

If your sales authority on the Amazon site is cancelled, and you have FBA inventory associated with this French site in the Amazon fulfillment center, you should submit your inventory removal and let Amazon dispose of your inventory or return your inventory. If you do not submit a removal order within 30 days after you receive the notification that the sales permission has been cancelled, Amazon may discard your inventory. We will regularly check the inventory of Amazon fulfillment centers throughout Europe (including the Amazon fulfillment centers in France). (You can find more information about removing inventory by searching in the seller's background)

Question 3: I have removed all the products on the French site, do I still need to upload a French VAT number?

Whether you list products on the Amazon France site does not affect your being required to upload a French VAT number. The French Anti-Fraud Act requires Amazon to collect the French VAT number of all sellers who sell goods in or out of France that are taxable (regardless of where the product is listed on Amazon).

Question 4: According to the French Anti-Fraud Act, do I need to pay historical taxes and fees?

The French tax office may assess historical unpaid taxes and require you to pay them.

Note: The information is from the official release of Amazon, with a few changes.

Related News

- 2021-06-08UPS Announcement: Parts of Europe are affected by the epidemic

- 2021-06-08Can epidemic prevention materials be exported? When will the air freight price increase? Let's take care of two things that are popular in cross-border circles

- 2021-06-08Amazon notice: Do not upload a French VAT number or be prohibited from selling

- 2021-06-08Seller’s note: Amazon adjusts European logistics costs

- 2021-06-08Canada's CN railway transportation is blocked, and some containers are delayed in arrival at the port

- 2021-06-08Affected by the new coronavirus epidemic, UPS suspends pickup and delivery services in some cities in Italy

- 2021-06-07U.S. Amazon CVG3 warehouse closed

- 2021-06-07Update of logistics channel information under the influence of the epidemic